Singapore Exchange (SGX) is turning once more towards China as a key source of growth after a few wary years marred by a number of S-chip scandals.

"As China becomes more and more important for us and we do more and more in China. . . It will be an expansion of the team (in China), both in Beijing and Shanghai, where we see a lot of our clients," SGX chief executive Magnus Bocker said on Wednesday at a results briefing.

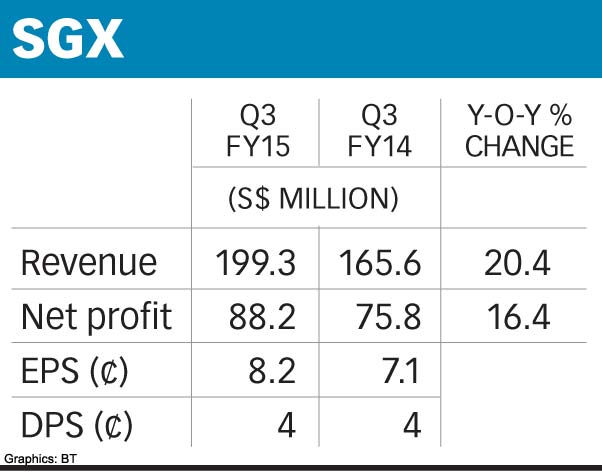

Mr Bocker's comments came as SGX said net profit for the third fiscal quarter, which ended in March, grew 16.4 per cent to S$88.2 million, or 8.2 Singapore cents per share, as the securities business ended a five-quarter slide. Revenue rose 20.4 per cent to S$199.3 million.

Nine-month net profit was up 3.9 per cent to S$252.4 million, or 23.6 Singapore cents per share. SGX is maintaining its quarterly dividend of four Singapore cents per share.

SGX shares closed at S$8.52 on Wednesday before the results were announced.

Mr Bocker, who will leave SGX after his current employment term ends on June 30, declined to comment about the search for his successor.

Securities revenue increased by one per cent to S$52.8 million, the first quarter in six in which the segment posted year-on-year revenue growth.

Mr Bocker noted that lower average clearing fees and smaller minimum trading blocks have improved retail participation in higher-priced stocks. The order-to-trade ratio fell to about 1.98 times from 2.97 times a year ago, suggesting that it took fewer orders to execute a trade.

The daily number of trades per retail client also rose 22 per cent to 2.8, with the increase mostly coming in index stocks.

The third quarter, however, was a quiet one on the listings front for the market operator, with listing revenue down 4 per cent to S$12.1 million.

But SGX has been stepping up efforts to draw listings from China, with former head of listings Lawrence Wong now head of the exchange's China business.

The exchange also announced earlier in the week a memorandum of understanding with the Chengdu authorities to encourage capital raising by Chengdu companies in Singapore.

"I think they have a lot of serious and sensible companies that I think will be well-received by investors here in Singapore," Mr Bocker said.

China is important to SGX beyond the potential for listing candidates. The derivatives market continued to climb, with interest in the China A50 index futures helping derivative revenue to grow 52 per cent to S$80 million in the third quarter.

Mr Bocker said fixed-income and commodities were two other areas in which Singapore offered Chinese companies an avenue to raise capital, noting robust investor interest and expertise in those asset classes.

"Singapore is a real, strong foothold for the fixed-income market," he said.

This article was first published on April 23, 2015.

Get The Business Times for more stories.